Automated Market Makers

An Automated Market Maker (AMM) allow digital assets to be traded without permission by using liquidity pools instead of a traditional market of buyers and sellers (an orderbook).

AMMs are powered by liquidity providers, that provide a pair of assets to a pool that sets the price and liquidity of a certain pool.

You can read more about AMMs here.

Constant Product Market Makers

A Constant Product Market Maker (CPMM) is an AMM algorithm that was initially designed and created by Uniswap where the algorithm

aims to keep a constant ratio of assets in a pool. The constant is usually denoted as k and is defined as the product of the number of each asset in the pool:

CPMMs ensure that a pool cannot be drained of a certain asset, unlike Constant Sum Market Makers. This leads to what is called execution slippage, which is the difference between the actual price (ratio of assets), and the price at which a trade is executed.

Example

If a trader wants to swap 10 X tokens for Y tokens in this pool, the amount of Y tokens that the trader receives can be calculated using the formula:

Given: ,

The calculation for Y tokens is:

According to the k-constant, the pool should contain 90.9 Y tokens. Consequently, the trader should receive the difference of:

tokens

The trader receives 9.1 Y tokens instead of the expected 10 Y tokens based on a 1:1 price ratio in the pool (1X = 1Y). This variance between expected and received tokens is the slippage.

Limitations

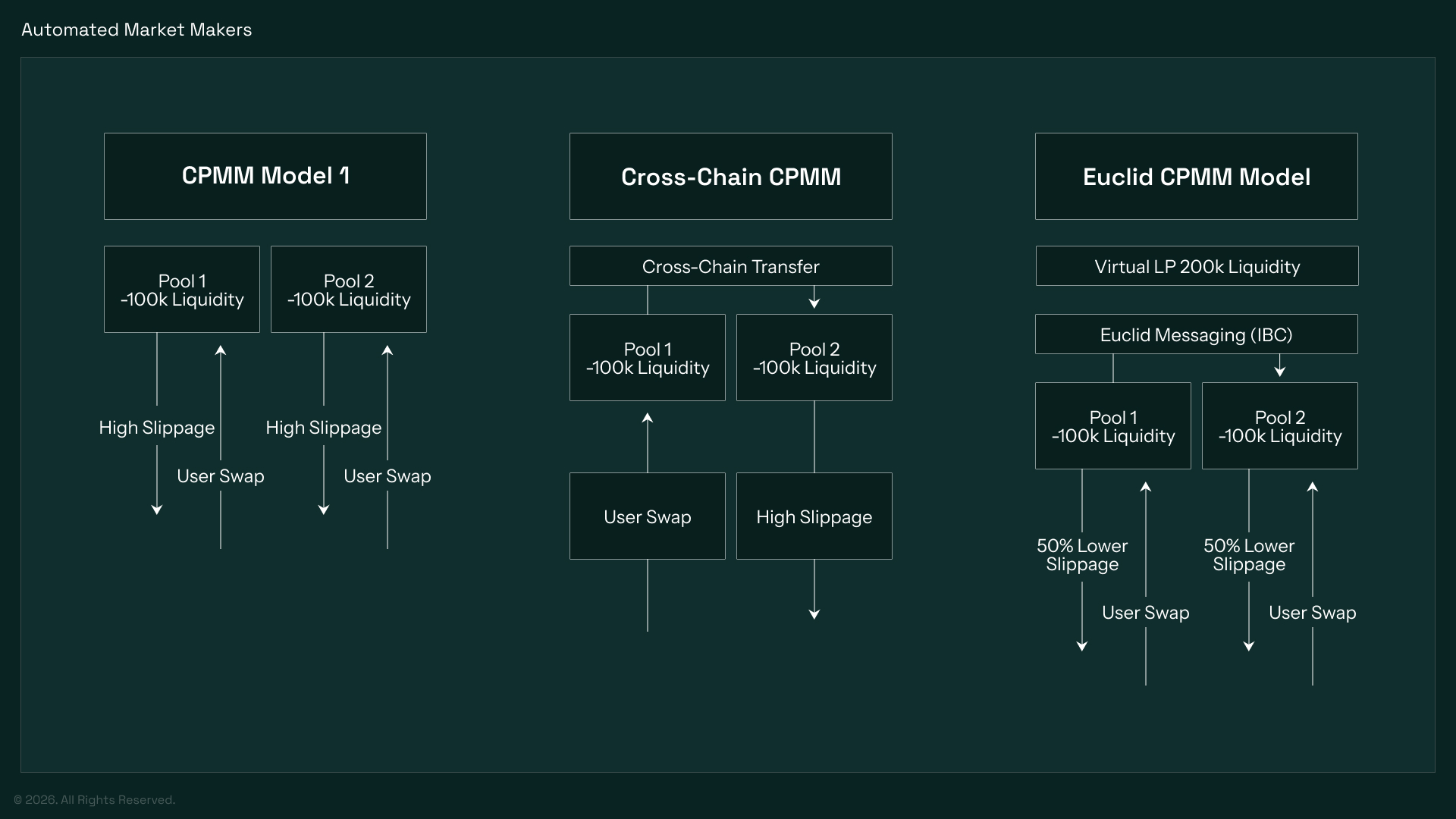

Currently, a CPMM pool relies solely on the assets in the pool smart contract in order to calculate the price and the slippage of the transaction. This creates what we call an inefficient market, since the smart contract does not have access to all the market information outside of its own component.

This means that although $20,000,000 of liquidity can exist outside of a smart contract for this pair across the blockchain, if the pair has $200 of liquidity, the slippage and inefficient pricing make it unusable.

Euclid's Solution

Euclid aggregates liquidity from multiple token reserves across various blockchains, creating a unified pool for each token pair. This significantly increases the depth of liquidity, reduces slippage, and enables more efficient trading.

Example

Assuming Euclid is connected to just 2 pools, each having 100 X and 100 Y tokens, the same trader mentioned above would get the following for the same transaction on an exchange using the Euclid layer:

Given:

The calculation for Y tokens is:

This will result in the trader receiving:

which is a 50% decrease in slippage.

Research

Our team has written extensively about CPMM and its limitations in creating efficient markets. If interested in going in depth on the Zero-Sum Game this creates, please read more here.